In today’s competitive financial landscape, attracting and retaining top advisory talent is paramount. While a competitive, transparent, and fair compensation process is foundational to this, C-suite leaders must ask a more critical question: Is our advisor compensation framework a strategic asset, or a hidden liability impacting our end-to-end revenue management cycle?

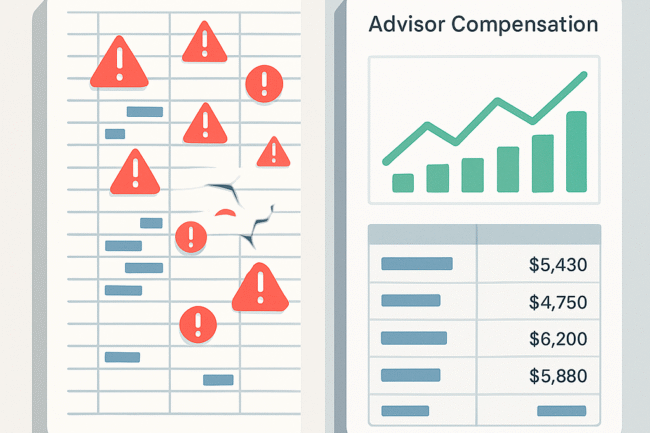

For many firms, the answer is unsettling. Makeshift spreadsheets, repurposed generic tools, or inadequately designed platforms are often struggling to manage the intricate revenue streams of the wealth management industry. If your organization relies on such improvised solutions, it could be silently hemorrhaging millions in potential revenue and creating significant operational drag.

It’s time to put your current advisor compensation system under a strategic performance review.

The High Stakes of Inadequate Compensation Systems

The dynamism of the wealth management sector – with its diverse transaction types, evolving fee structures, frequent M&A activities, and shifting regulatory demands – necessitates an exceptionally agile and robust compensation management solution. Without it, your firm isn’t just risking inaccurate payouts; it’s risking its strategic objectives.

Consider these critical blind spots that may exist within your current framework:

- Strategic Misalignment: Does your system truly ensure every dollar allocated to compensation directly supports your firm’s immediate priorities and long-term growth ambitions? Or could it be inadvertently incentivizing the wrong behaviors?

- Opacity and Inefficiency: Are calculations transparent and easily understood, fostering advisor trust? Or could complex, opaque processes be masking costly inefficiencies and discrepancies, potentially derailing your financial goals?

- Inflexibility in the Face of Change: Can your system seamlessly accommodate dynamic payout structures, integrate new entities post-M&A, and adapt to regulatory shifts without massive operational overhauls? Rigidity here is a direct threat to scalability and responsiveness.

- Industry-Specific Gaps: Is your solution truly tailored to the unique, multifaceted financial mechanics of wealth management, or is it a generic platform that fails to grasp the nuances of your revenue streams?

Beyond Basic Functionality: The Data and Integration Imperative

Minimizing compensation inefficiencies and maximizing profitability demands more than basic calculation capabilities. It requires sophisticated software architected for:

- Complex Data Mastery: Your system’s outputs are only as reliable as its data inputs and logic. It must be configurable to manage diverse incoming and outgoing billing activity, intricate fee schedules, multiple incentive tiers, and both transaction-based and flat-fee models with precision. This is merely the baseline.

- Seamless Ecosystem Integration: Advisor compensation doesn’t operate in a vacuum. It’s a critical component of your entire revenue lifecycle management. A truly effective solution integrates:

- Strategic Consulting Expertise: Applying industry best practices to architect compensation plans that drive desired outcomes.

- Enterprise-Grade, Purpose-Built Software: Deploying technology specifically designed for the complex variables inherent in total advisor compensation and rewards.

- Actionable Business Insights: Delivering detailed reports and statements that don’t just show numbers but illuminate revenue leakage, billing inefficiencies, and opportunities to optimize incentive structures for greater profitability.

The Real Cost of Miscalculation: A Multi-Million Dollar Risk

Consider a simple scenario: an advisor discounts a $100 service to $80. Your firm’s agreed share is 50%, or $40. An inadequately configured system might incorrectly pay the advisor $50 (50% of the original $100) and allocate only $30 to the firm. This single error directly erodes your profitability.

Now, amplify this across thousands of transactions, customized incentives, complex split agreements, and performance-based payout tiers. Even minor, systemic misconfigurations can compound into substantial financial losses annually. In an industry laden with such complexities, the potential for value leakage is immense if your compensation engine isn’t meticulously engineered and managed.

Transforming Compensation from an Expense to a Strategic Driver

In an environment where a single basis point improvement can yield significant financial advantage, settling for a sub-optimal compensation system is an economic misstep.

Legacy systems or generic solutions may offer a temporary reprieve, but they ultimately create a competitive disadvantage.

By re-evaluating your compensation framework and partnering with solutions that offer deep industry insight and flexible, purpose-built technology, you move beyond merely mitigating revenue leakage. You unlock new pathways for sustainable growth, enhance advisor loyalty, and fortify your firm’s financial health. Just as an underperforming business unit demands executive attention, an underperforming compensation system warrants immediate strategic review.

Is your firm ready to transform its advisor compensation from a potential liability into a strategic driver of growth? Contact us to explore how PureFacts can help optimize your revenue lifecycle.

— James Iacabucci is the Director, Product & Engineering at PureFacts Financial Solutions, an award-winning provider of end-to-end revenue management solutions for the investment industry, helping firms maximize profitability, ensure compliance and deliver exceptional client service.