PureFacts Financial Solutions (“PureFacts”), an award-winning provider of end-to-end revenue management solutions for the investment industry, today announced the appointments of two executives to its C-suite: Jennifer Bouyoukos as chief people officer (CPO) and JJ Jeffries as chief customer officer (CCO). Both roles are newly created positions within the company, reflecting PureFacts’ continued growth and evolving organizational needs.

“Adding these professionals to our growing roster of talent underscores our commitment to scaling with purpose and investing in people and client success,” said Pete Hess, president of PureFacts. “Jennifer and JJ bring world-class leadership and a strong record of transforming organizations. They will play a critical role in helping us empower financial services firms through data-driven revenue growth.”

Bouyoukos brings more than 25 years of global HR leadership experience across technology, media and financial services sectors. She has held senior HR roles at SAP, RBC, Manulife, Entertainment One and Kobo, where she led large-scale cultural transformation, merger & acquisition (M&A) and international expansion initiatives. At PureFacts, she will be responsible for leading all aspects of the company’s people strategy. Her focus will include talent acquisition, executive development, diversity and inclusion and organizational design to support the firm’s rapid growth and evolving culture.

“I’m looking forward to joining the PureFacts team at such an exciting inflection point,” said Bouyoukos. “The company’s purpose-driven vision, client focus and growth mindset deeply align with my own values as a people-first leader. Together we’ll continue to build on the company’s strong foundation to help make it a destination for top talent.”

Jeffries has more than 15 years of experience in client success, business transformation and growth strategy, most recently serving as chief revenue officer at reverse logistics platform Vendidit. His previous roles include vice president of channel strategy at TransImpact and managing principal at Capco, where he focused on fintech partnerships. At PureFacts, he will lead all client-facing functions, enhancing customer satisfaction, cultivating long-term strategic partnerships and ensuring alignment between the firm’s solutions and evolving customer needs.

“PureFacts is redefining what’s possible for financial services firms through innovative data and revenue intelligence,” said Jeffries. “I’m eager to champion the client voice and help ensure our teams deliver best-in-class outcomes that drive meaningful growth for our partners.”

These strategic appointments reflect PureFacts’ continued momentum following a major capital investment from GrowthCurve Capital in 2024. The company has made several recent C-suite additions, naming Pete Hess as president in October 2024, followed by the recruitment of Robert O’Boyle as chief revenue officer, Anuradha Dodda as chief technology officer and Stephen Tkaczyk as chief financial officer all in March 2025.

To learn more about PureFacts’ offerings, visit purefacts.com.

###

About PureFacts Financial Solutions

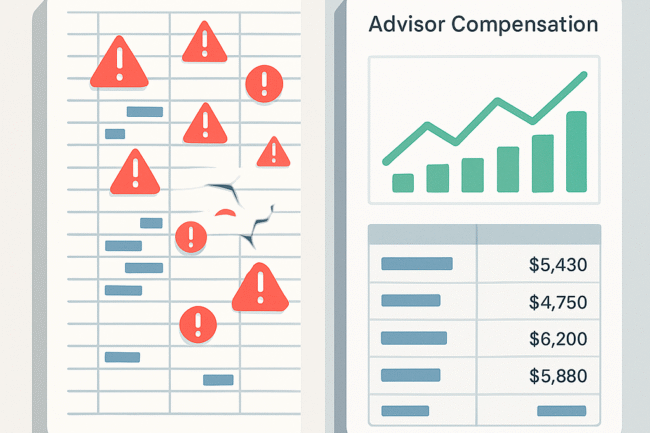

PureFacts Financial Solutions is an award-winning provider of End-to-End Revenue Management solutions for the investment industry. PureFacts helps some of the largest and most recognizable wealth management, asset management and asset servicing firms manage and grow their revenues. The PureRevenue Platform enables scalable revenue management by powering the entire revenue lifecycle. Firms calculate, collect, distribute, incentivize and optimize their revenues using PureFacts AI-enriched fees engine, incentive compensation application and compelling revenue business intelligence powered by a single system of record for revenue management. PureFacts’ clients outperform by retaining more customers, delivering incremental value, improving productivity, properly incentivizing advisors and distributors, preventing costly mistakes and finding optimization opportunities. With offices in Canada, the USA, and Europe, PureFacts has been recognized for its innovation and excellence including selections to the WealthTech100, AIFinTech100 and ESGFinTech100 awards.

Drive revenues. Eliminate leakages. Increase growth velocity. Learn more at www.purefacts.com.

About GrowthCurve

GrowthCurve Capital is a private equity firm focused on building businesses by leveraging data, analytics, and machine learning, combined with a comprehensive approach to human capital, to seek to accelerate growth and drive long-term value. Founded by Sumit Rajpal, former Global Co-Head of the Goldman Sachs Merchant Banking Division, the firm focuses on data-rich, control-oriented private equity investments primarily across the technology and information services, healthcare, and financial services sectors. For more information, please visit www.GrowthCurveCapital.com and follow the firm on

www.linkedin.com/company/growthcurvecapital.