For firms in the wealth and asset management industry, the path to higher profitability has become a core strategic priority. But it’s not just about AUM growth and operational efficiency; one of the most pressing, yet often overlooked, threats to profitability is revenue leakage.

Revenue leakage, the silent erosion of legitimately earned income, has been a persistent issue in many organizations – one that firms recognize but struggle to fully manage. While it rarely triggers alarms, its impact compounds over time, making it a significant threat to the profitability growth objective. With industry estimates showing up to 5% of annual revenue quietly slipping through the cracks, CFOs can no longer afford to ignore the blind spot. In an industry where fee compression is intensifying, margins are tightening, owners are looking for more revenue and regulatory scrutiny is at an all-time high, plugging these leaks with purpose-built solutions is a direct path to margin recovery and enterprise value creation.

The Silent Drain on Profitability CFOs Must Address

Revenue leakage in the wealth and asset management industry is not a rounding error. It is a structural issue that chips away at profitability across the revenue lifecycle: client billing, advisor compensation, and contract execution. According to EY, the typical firm is losing between 1% and 5% of earned revenue annually due to misconfigurations, data fragmentation, and manual processing failures.

To put this in perspective: a firm with $50 billion in AUM and average fees of 50 basis points is generating $250 million in annual revenue. A 3% leakage rate equates to $7.5 million in lost revenue; nearly all of that hits EBITDA directly.

Why? Because the cost of servicing those clients has already been incurred. Leaked revenue isn’t deferred or recoverable later, it’s high-margin income that simply vanishes.

What’s Driving the Leakage?

The wealth and asset management industry’s increasing complexity is a major culprit. Client demands for personalization, the proliferation of hybrid and performance-based fee models, and the rise of SMAs, UMAs, and alternative assets have pushed many legacy billing systems beyond their limits. Key leakage sources include:

1. Billing Complexity & System Mismatches

Tiered fee schedules, AUM-based breakpoints, and custom discounts are difficult to track manually. Errors occur when household assets aren’t aggregated properly, fee thresholds are misapplied, or negotiated terms aren’t enforced systematically. In some firms, even dividend payments in multi-manager UMA structures go unbilled due to software limitations.

2. Manual Processes & Spreadsheet Dependency

Despite the stakes, many firms still rely on spreadsheets to calculate and track fees. One mis-keyed digit—like billing $5,000 instead of $50,000—can repeat across billing cycles undetected, costing the firm hundreds of thousands over time. A Deloitte case study showed that in a sample of 20,000 transactions, one firm was leaking 3–4% of its revenue due to discrepancies between paper contracts and billing data.

3. Advisor Compensation Misalignment

Revenue leakage affects advisor payouts too. Complex grid-based compensation models rely on accurate billing to function properly. If client fees are calculated incorrectly, it leads to incorrect advisor commissions. The result? A double loss: leaked client revenue and erroneous payouts that require time-consuming reconciliations and risk eroding advisor trust.

4. Contractual Blind Spots

Wealth Management Agreements and Investment Policy Statements often contain bespoke clauses e.g. fee adjustments, late payment penalties, and special asset class billing, that are never activated in billing systems. Discounts meant to be temporary or conditional persist indefinitely. These “sticky discounts” and unenforced terms represent a major, recurring drain.

5. Siloed Systems & Poor Data Hygiene

Disconnected CRMs, portfolio management tools, billing engines, and accounting platforms create inconsistent data flows. A client’s household status might be updated in one system but not another, leading to fee miscalculations. In the absence of a single source of truth, leakage is inevitable.

This is a CFO’s problem, not an Ops issue

Historically, revenue leakage was seen as a back-office problem: a billing team inefficiency or a compliance box to check. But that view is dangerously outdated.

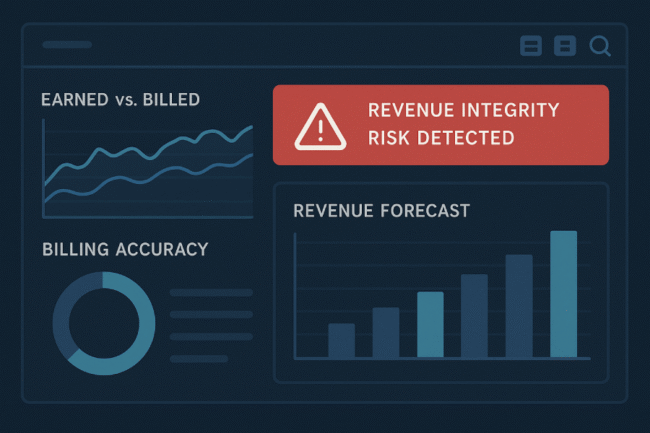

In 2025, CFOs are being measured not only on cost control, but on the accuracy, reliability, and defensibility of revenue itself. Leakage undermines all of this:

- EBITDA Distortion: Every dollar leaked is a dollar off the bottom line. And since the costs have already been incurred, there’s no offset. CFOs who recover just 2% in leakage see immediate, high-margin gains.

- Cash Flow Risk: Delayed or incorrect billing means delayed cash inflows. This stresses liquidity, increases borrowing needs, and introduces volatility into financial planning.

- Forecasting Errors: If earned vs. billed revenue isn’t reconciled in real time, forecasts and budgets are built on shaky ground.

- Valuation Risk in M&A: Operational issues like revenue leakage uncovered during due diligence can significantly depress deal value. In some cases, these issues trigger what McKinsey refers to as a “valuation double jeopardy”: not only does the target suffer a lower EBITDA due to systemic inefficiencies, but acquirers may also assign a lower valuation multiple because of elevated perceived risk. The result? A reduced enterprise value—or worse, a failed deal.

In short, revenue leakage directly undermines a CFO’s credibility with the board, investors, and auditors; it impacts the integrity of financial reporting.

2025: The Perfect Storm

Several converging forces make this the moment for CFOs to act:

- Fee models are growing more complex as firms compete for clients with customized pricing.

- Regulatory bodies like the SEC are cracking down on billing discrepancies. In 2022, the SEC imposed a record $6.4 billion in fines, much of it tied to misbilling and inadequate disclosures.

- Margin pressure is relentless. With fee compression and rising tech and compliance costs, even a 1–2% recovery can shift a firm from break-even to profitable.

- Industry consolidation is accelerating. Clean, defensible revenue streams are critical to maximize value in a sale or unlock hidden upside in an acquisition.

- Digital transformation is risky. Billing migrations and new platform integrations often introduce fresh leaks if not governed properly.

What Leading CFOs Are Doing About It

Forward-thinking CFOs are reframing revenue leakage from a back-office inefficiency into a strategic lever for profitability, valuation, and operational excellence.

They’re adopting a proactive playbook that includes:

- Establishing revenue integrity KPIs like “earned vs. billed” and “billed vs. collected”

- Building revenue assurance into FP&A, modeling leakage scenarios into forecasts

- Leading due diligence around billing systems in M&A conversations

- Driving cross-functional accountability between finance, ops, legal, tech, and sales

- Investing in technology that closes the loop across billing, reconciliation, and advisor compensation

The Path Forward: Stop Plugging Leaks and Leverage Purpose-Built Tools

Manual audits and legacy workarounds are no match for the scale and complexity of modern wealth and asset management operations. Best-in-class firms are turning to integrated, AI-powered revenue management platforms that automate billing, reconcile anomalies, and align advisor compensation.

New business growth is hard-fought and costly. But recaptured revenue? It’s already earned. It’s pure margin. And it’s waiting to be unlocked by CFOs with the foresight to take control.

In 2025, revenue leakage is the highest-impact opportunity hiding in plain sight. The time to address this is now.

If you’re ready to understand how your firm stacks up against leading wealth and asset managers in capturing earned revenue, reach out to PureFacts Financial Solutions: the only purpose-built revenue optimization platform for the wealth and asset management industry.

Founded in 2010, PureFacts is a global financial technology company specializing in revenue optimization solutions for the wealth and asset management industry. We partner with 7 of the top 10 leading firms to develop and implement advanced revenue lifecycle solutions — from billing to compensation to predictive insights.

With over $15 trillion in assets on our platform and millions of accounts processed daily, we help 130+ firms capture 100% of their earned revenue with the lowest cost of oversight and operations. PureFacts delivers the visibility and intelligence CFOs need to drive profitability, reduce leakage, and make data-informed decisions for long-term performance.